The impact of the Child Tax Credit payments on the 2021 tax returns

The Advance Child Tax Credit (ACTC) is an expansion of the American Rescue Plan that gives qualifying families another source of monthly income until the end of 2021. Since July 15, 35 million Americans met the requirements for the advance payments and 1.5 million have already unenrolled. However, some families might not be aware of the ACTC impact on their 2021 tax return. As a tax professional, you can explain the tax change and show them how the child tax credit calculator works to decide the best outcome for their financial situation.

What is the amount your customer might be receiving?

Based on the IRS Child Tax Credit calculator , the amounts issued are $ 3,600 for children ages 5 and under and $3,000 for children ages 6 through 17 until the end of 2021.

When calculating the advance monthly payments, you have to consider the adjusted gross income (agi) from the 2020 IRS Form 1040, line 11, or the 2019 IRS Form 1040, line 8b. On top of that, you might want to check line 45 or 50 from the 2019 and 2020 Form 2555, Foreign Earned Income as well as gross income from places such as Puerto Rico or American Samoa.

If that is the case, you will want to inform your customer that the IRS considers all their sources of income as a modified adjusted gross income to determine their monthly Advance Child Tax Credit payment.

Basic information you will need for a Child Tax Credit calculator:

- Filing status (married filing jointly or married filing separately, single, head of household, widow/er)

- No. of children age five and under until the end of this year.

- No. of children age six to 17 until December 31st 2021.

Five reason to unenroll or opt out your customers from Child Tax Credit payments

The second payment is scheduled for August 13, you and your customers should decide if claiming the 2021 child tax credit is the right choice.

Based on the child tax credit calculator result and a full assessment of your customers’ financials, you will be able to determine if they should unenroll or opt out or keep the monthly payments. Helping your clients navigate the complicated tax world will improve your relationships and attract new ones.

Reach out to your your customer base to find out if they are in one of the situations below:

- If their amount of income taxes owed for this year could be greater than the expected tax refund. It’s important to highlight that The Child Tax Credit payments are only an advance from 2021 credits. This means that the amount of their refund may be either reduced or the amount of tax owed may increase when they file their tax return.

- Their tax situation changed for a reason such as a divorce.

- The income limit is important factor. If their household income has gone up, for reasons such as a new job that might affect their payments.

- If any of their claimed dependent(s) on their 2020 tax return are aging out of the age 6 to 17 bracket before the end of 2021.

- Your customers prefers to receive their traditional lump sum for their 2021 tax refund.

What if your customer needs to unenroll or change their information?

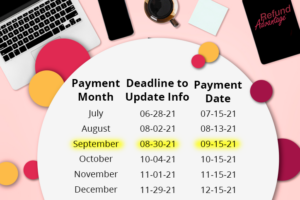

Unenrollment can be done on the Child Tax Credit update portal. This action must be done at least three days before the first Thursday of next month by 11:59 pm ET. So, customers that wish to unenroll or opt out of next payment will have to do so by August 30th.

The unenrollment process may take up to seven calendars and it’s a one time action but re-enrollment is possible later . Please note, each spouse needs to unenroll, otherwise one spouse will get “half of the joint payment” according to the IRS.

According to the IRS, the child tax credit payments and updates are scheduled for the following dates:

Who can benefit from the 2021 Advance Child Tax Credit?

If your customers don’t take any action, they will receive the credit every month, until the end of the year. They can use the funds as they wish, for various purchases or personal plans. However, a child tax credit calculator will not give you the full picture of your customers’ financial situation. Keep in mind that the credit is particularly helpful for low-income families that face economic hardship during the COVID-19 pandemic.

The payments offers families another source of monthly income and peace of mind. It gives them the chance to better plan the funds in times of need and avoid harsh consequences.

How to reach out to your customers proactively.

This is a great opportunity to build relationships and prove your expertise. Take it one step further and offer your customers child tax credit payment appointments. Use this time to go over financial information and help them choose the best option.

Even for customers that have already made a decision on their CTC payments, it’s a great opportunity to check in with them. Then offer to guide them if they’ve changed their minds.

You can use your business social media page to keep in touch with your customer base. Tax updates and appointment promotions can be great content for your page. It would be best, if you could post on a regular basis reminding them that you are there to help.

If you need refresher, check our post about the ACTC basics.