Refunds up to 4 Days Faster¹

The FasterMoney® Visa® Prepaid Card² is the disbursement solution for independent tax preparers like you who want to make tax time less stressful for themselves—and their customers.

Ready to set your office up for success this tax season?

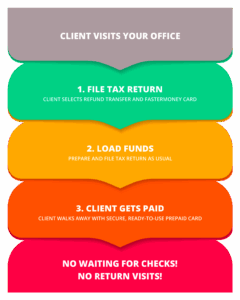

HOW STREAMLINED DISBURSEMENTS WORK

Get your clients in and out your office fast! With the FasterMoney Visa Prepaid Card, you can simplify your disbursement process and offer a seamless experience that keeps everyone smiling.

Skip the paper checks, eliminate tax office return visits, and help your clients get their tax refunds, Taxpayer Advance Loan or December Loyalty funds in real time—up to four days faster than traditional methods4.

STEP-BY-STEP: FROM FILING TO FUNDS IN HAND

Bonus

If your client is approved for a Taxpayer Refund Advance Loan3, those funds will load within minutes!

Ready to streamline your workflow?

WHY CHOOSE THE FASTERMONEY VISA PREPAID CARD FOR DISBURSEMENTS?

Make this tax season smooth for you and your clients. With the FasterMoney Card, you’ll unlock a simple, safe, and efficient way to disburse tax refunds, holiday money, and Taxpayer Advance Loans.

Ditch the Physical Paper

No more printing, tracking, or mailing paper checks. Load refunds and Taxpayer Advance Loans directly onto the FasterMoney card and let your clients walk out, funds in hand! UP TO FOUR DAYS FASTER4.

Save Everyone a Trip

Clients can leave your office with their card the same day—no need for multiple appointments or frustrating callbacks.

Less Hassle, More Peace of Mind

Your tax office will enjoy $0 in-season ERO marketing fees6 Taxpayer Advance Loans when loaded to the FasterMoney card, and rest easy knowing the funds are FDIC insured10 and protected by Visa’s Zero Liability policy9.

Ready to Streamline your Workflow?

NO MORE PAPER CHECKS. NO MORE DELAYS.

HAVE YOUR CUSTOMER GET PAID UP TO 4 DAYS FASTER!

Why wait when your clients can receive their pay out fast and securely than with a traditional check! That means less waiting, more convenience, and a positive taxpayer experience.

Did You Know?

When your clients choose FasterMoney, they skip the wait for paper checks and unnecessary trips back to your office!

Ready to speed up tax refunds for your customers?

*Data provided by Prepaid Card Market Trends, Share | CAGR of 23.2%

**Quoted from CoinLaw Prepaid Card Statistics 2025: Must-Know Growth Factors, October 21, 2025

Security & Support: Trusted Protection for You and Your Customers

Rest easy knowing the FasterMoney Visa Prepaid Card is built with security and support at every step—for both you and your clients.

Lost Card? No Problem

If a card is misplaced or stolen, both the card and its funds can be quickly replaced, minimizing hassle and downtime. All funds are FDIC insured10 and protected with Visa’s Zero Liability policy.

Real-time Updates

Your customers can setup automatic text and email alerts for important transactions such as when funds are loaded through the Manage My Card app5.

Support contact information for tax preparers and taxpayers

FASTERMONEY Visa Prepaid Card Tax

Preparers Support:

![]() New Sales Support: 855-547-4771

New Sales Support: 855-547-4771

Taxpayer Card Support:

GET STARTED: ENROLL YOUR OFFICE TODAY!

Setting up your office with the FasterMoney Visa Prepaid Card is quick and easy! Plus, you get to save more of your hard-earned money by avoiding the in-season marketing fee6 when you offer Taxpayer Advance Loans paid out on the FasterMoney card. Start making tax season smooth for both you and your clients—no extra, complicated steps!

OUR 2, EASY STEP-BY-STEP ENROLLMENT

Sign Up with Your Tax Software

Select “Refund Advantage” in the bank application for the ultimate all-in-one solution!

Login to Your Refund Advantage Account

Complete your enrollment and manage your Refund Advantage account conveniently on our site.

THAT’S IT!

START ISSUING CARDS:

As soon as your enrollment is approved, you can start loading tax refunds and Taxpayer Advance loans right onto the FasterMoney card for your clients.

Have questions? Check our FAQs or contact our award-winning support team—we’re here to help every step of the way.

HAVE QUESTIONS? WE’RE HERE TO HELP!

Find quick answers to the most common questions about the FasterMoney Visa Prepaid Card and our services below.

Who is eligible to use the FasterMoney® Visa® Prepaid Card?

Are there any fees for tax preparers or clients?

How do Refund Transfers, December Loyalty, and Taxpayer Advance Loans work with the FasterMoney Card?

Why offer the FasterMoney Card to your clients?

1. The FasterMoney Visa® Prepaid Card is issued by Pathward®, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc.

2. The Refund Transfer is an optional tax refund-related product offered by Pathward®, NA., Member FDIC. The Refund Transfer is not a loan. E-filing of tax return is required to be eligible for the product. Subject to approval. Fees apply. See terms and conditions for details.

3. The Refund Advance is an optional tax-refund related loan provided by Pathward, N.A., Member FDIC (it is not the actual tax refund) at participating locations. Program availability and loan amounts may vary based on state and software provider. The amount of the loan and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer. Fees for other optional products or product features may apply. Tax returns may be filed electronically without applying for this loan. Loans offered in amounts of $250 (where available), $500, $1,000, 25%, 50%, or 75% of your expected tax refund up to $7,000, with interest-based applicants receiving an average of $2,003.41; $7,000 available only to well-qualified applicants with a minimum expected tax refund of $9,569. Underwriting standards subject to change. When calculating the amount of your loan, the amount of your “expected” tax refund may be affected by any refundable tax credits and fees. Loans in the amounts of $250, $500, and $1,000 have an Annual Percentage Rate (APR) of 0.00%. Loans in the amounts of 25%, 50% or 75% of your expected tax refund have an APR of 36.0% with a minimum loan of $1,250. For example, $2,500 loan representing 50% of expected refund borrowed over 31-day term, total amount payable in a single payment is $2,576.44 including interest. Availability is subject to satisfaction of identity verification, eligibility criteria, and underwriting standards.

4. The speed at which the IRS will process your refund will not change. Early availability claim is based on a comparison of the FasterMoney Visa® Prepaid Card’s policy of making federal refunds available upon receipt of payment instruction versus the typical banking practice of making funds available at settlement. This early access requires deposit of your federal refund onto the FasterMoney Card and depends on the timing of the IRS’s submission of the payment as well as other payment instructions, and fraud prevention measures. Policy subject to change.

5. Third-party data rates may apply.

6. A marketing fee of $34.95 applies for every approved In-Season advance with a refund transfer or loans without a refund transfer. $0 marketing fees require use of the FasterMoney® Discover® Prepaid Card for disbursement.

7. While this feature is available for free, certain other transaction fees and cost terms, and conditions are associated with the use of this card. See cardholder agreement for more details.

8. For each out-of-network ATM withdrawal, FasterMoney charges a $2.50 fee. Plus, the ATM owner may charge a fee.

9. Visa’s Zero Liability policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Cardholders must use care in protecting their card and notify their issuing financial institution immediately of any unauthorized use. Contact your issuer for more detail.

10. Register your Card for FDIC insurance eligibility and other protections. Pathward, National Association is an FDIC-insured depository institution. Your funds are eligible for FDIC pass-through insurance to the extent they are held by Pathward and otherwise meet the regulatory requirements for pass-through insurance.